Let’s be real, folks. PayPal has been a game-changer for millions of people worldwide, but what about Nigerians? If you're wondering whether PayPal is available in Nigeria, you're not alone. In this article, we'll break it down for you step by step, so you don’t have to stress or second-guess yourself. Whether you’re an entrepreneur, freelancer, or just someone looking to make global transactions easier, we’ve got you covered. So, let’s dive right in!

Imagine this—you’re sitting in Lagos or Abuja, working hard on your online business or freelancing gig, and you hear about PayPal being the ultimate tool for online transactions. But hold up! Is it legit for Nigerians? Does it work the same way here as it does in other countries? These are valid questions, and trust me, they deserve answers. That’s why we’re here—to clear the air once and for all.

Now, before we get too deep into the nitty-gritty, let me tell you this: we’re going to cover everything you need to know about PayPal in Nigeria. From availability to restrictions, fees, and even alternatives if PayPal doesn’t cut it for you. This ain’t just a quick overview; it’s a full-on guide that will leave you feeling confident and informed. So, grab a drink, sit back, and let’s get started!

Daftar Isi

Is PayPal Available in Nigeria?

Benefits of Using PayPal in Nigeria

Limitations of PayPal in Nigeria

How to Sign Up for PayPal in Nigeria

Verifying Your PayPal Account in Nigeria

Alternatives to PayPal in Nigeria

Biography of PayPal in Nigeria

PayPal Usage Statistics in Nigeria

Why You Should Trust PayPal in Nigeria

Conclusion: Is PayPal Worth It for Nigerians?

Is PayPal Available in Nigeria?

Alright, let’s cut to the chase. The big question on everyone’s mind is: Is PayPal available in Nigeria? The short answer is yes, but with a twist. PayPal operates in Nigeria, and Nigerians can create and use PayPal accounts. However, there are some restrictions that you should be aware of, especially when it comes to sending and receiving money.

Here’s the deal: while Nigerians can sign up for PayPal and use it to receive payments, the platform doesn’t allow Nigerian users to send money to other countries. This one-way street has caused quite a bit of frustration among users, but don’t worry—we’ll explore why this happens and what you can do about it later in the article.

What Does PayPal Offer in Nigeria?

For those who can navigate the restrictions, PayPal offers a range of services that make online transactions smoother. You can:

- Receive payments from clients or customers abroad.

- Shop online at international stores that accept PayPal.

- Withdraw funds to your local Nigerian bank account.

- Use PayPal for subscription services.

While these features might seem basic, they’re incredibly useful for freelancers, entrepreneurs, and anyone looking to expand their business globally.

Benefits of Using PayPal in Nigeria

Now that we know PayPal is available in Nigeria, let’s talk about why you might want to use it. Here are some of the top benefits:

1. Global Reach

PayPal connects you to a worldwide network of businesses and individuals. Whether you’re selling handmade crafts or offering digital services, PayPal makes it easy to reach customers all over the globe.

2. Security

Security is a top priority for PayPal. The platform uses advanced encryption and fraud protection systems to keep your transactions safe. Plus, you can dispute charges if something goes wrong, giving you peace of mind.

3. Convenience

Let’s face it—online banking in Nigeria can sometimes feel like a hassle. PayPal simplifies the process by allowing you to manage all your transactions in one place. No more juggling multiple bank accounts or dealing with complicated wire transfers.

Limitations of PayPal in Nigeria

Of course, nothing is perfect, and PayPal in Nigeria is no exception. Here are some of the limitations you might encounter:

1. Sending Money Restrictions

As we mentioned earlier, Nigerian users can’t send money to other countries. This restriction can be a major inconvenience for those who need to transfer funds internationally.

2. Withdrawal Fees

Withdrawing funds from PayPal to your Nigerian bank account comes with a fee. While it’s not exorbitant, it’s still something to consider, especially if you’re dealing with large transactions.

3. Limited Currency Options

PayPal supports multiple currencies, but Nigerian users are limited to a few options. This can make it tricky if you’re working with clients who prefer to pay in less common currencies.

PayPal Fees in Nigeria

Let’s talk money. PayPal charges fees for various transactions, and it’s important to understand them so you’re not caught off guard. Here’s a breakdown:

1. Withdrawal Fees

When you withdraw funds from PayPal to your Nigerian bank account, you’ll typically pay a flat fee of $5.40 per transaction. Keep in mind that this fee is subject to change, so always check PayPal’s official website for the latest rates.

2. Conversion Fees

If you’re receiving payments in a currency other than the Nigerian Naira, PayPal will convert it for you. However, there’s a catch: they charge a conversion fee, which is usually around 2.5% of the transaction amount.

3. Merchant Fees

If you’re using PayPal to sell goods or services online, you’ll pay a merchant fee for each sale. This fee is typically around 2.9% plus a fixed fee, depending on the currency.

How to Sign Up for PayPal in Nigeria

Signing up for PayPal in Nigeria is relatively straightforward. Here’s a step-by-step guide to help you get started:

Step 1: Visit the PayPal Website

Head over to PayPal’s official website and click on the “Sign Up” button. Choose the type of account that best suits your needs—personal or business.

Step 2: Provide Your Details

You’ll need to enter your personal information, including your name, address, and email address. Make sure everything is accurate, as this will be important for verification later on.

Step 3: Link Your Bank Account

To complete your account setup, you’ll need to link your Nigerian bank account. This allows you to withdraw funds directly to your bank when you receive payments.

Verifying Your PayPal Account in Nigeria

Once you’ve signed up, it’s time to verify your account. Verification is essential if you want to access all of PayPal’s features. Here’s how to do it:

1. Confirm Your Email Address

Check your inbox for a confirmation email from PayPal. Click the link inside the email to verify your account.

2. Link and Confirm Your Bank Account

PayPal will send a small deposit to your bank account. Once you receive it, log back into your PayPal account and enter the amount to confirm the link.

3. Provide Identification

Depending on your account type, you may need to upload a copy of your ID or passport for verification purposes. This step ensures that your account is secure and compliant with international regulations.

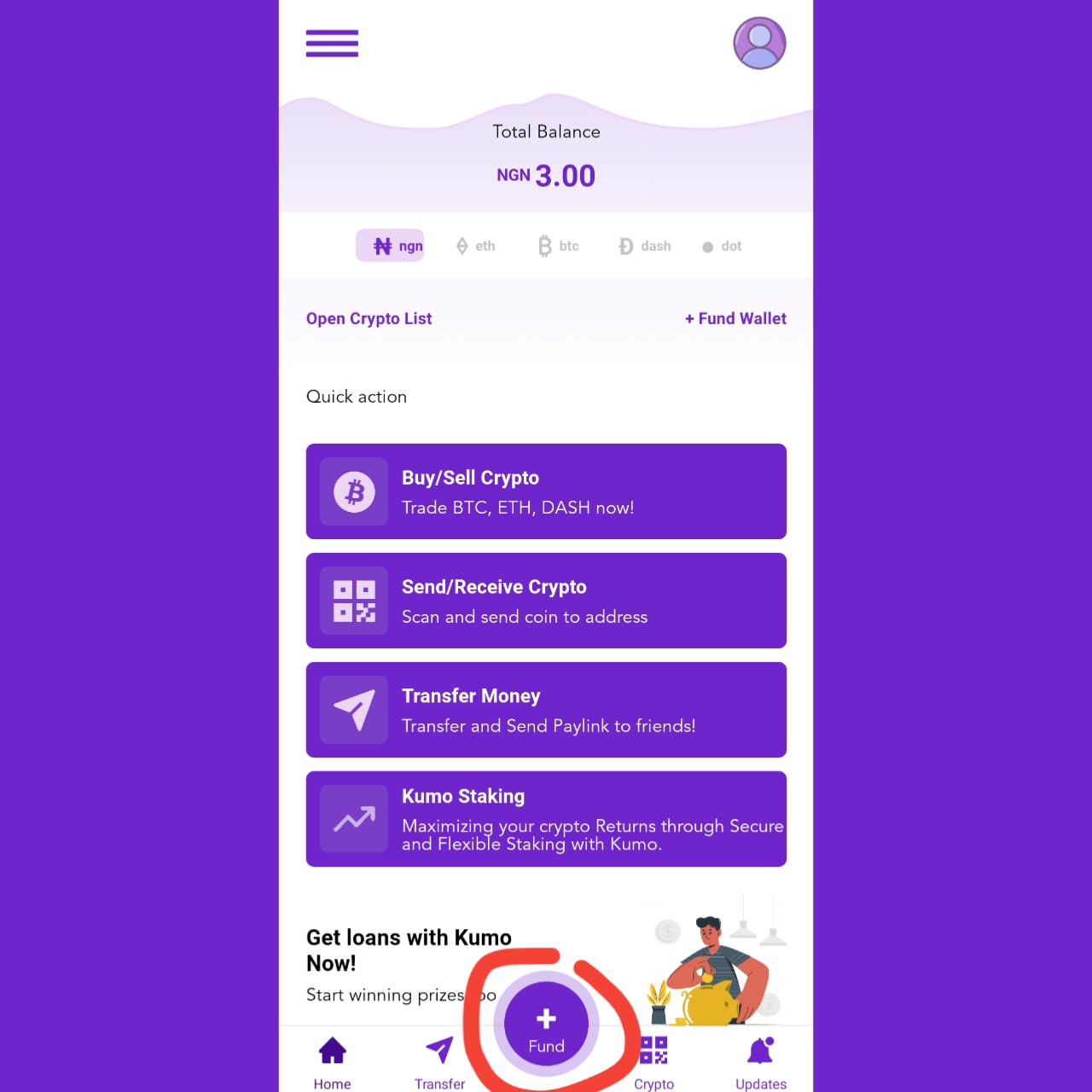

Alternatives to PayPal in Nigeria

While PayPal is a popular choice, it’s not the only game in town. If you’re looking for alternatives, here are a few options to consider:

1. Paystack

Paystack is a Nigerian-born payment platform that offers a wide range of services, including online payments, subscription management, and more. It’s a great option for local businesses looking to process payments within Nigeria.

2. Flutterwave

Flutterwave is another popular payment platform in Nigeria. It allows you to accept payments from both local and international customers, making it a versatile choice for businesses of all sizes.

3. Skrill

Skrill is a global payment service that offers many of the same features as PayPal. It’s a good alternative if you’re looking for a platform with fewer restrictions on sending and receiving money.

Biography of PayPal in Nigeria

Let’s take a quick look at PayPal’s journey in Nigeria. Here’s a summary of its history and impact:

| Year | Event |

|---|---|

| 2010 | PayPal officially launched its services in Nigeria. |

| 2015 | PayPal introduced withdrawal options for Nigerian users. |

| 2020 | PayPal expanded its merchant services to include more Nigerian businesses. |

PayPal Usage Statistics in Nigeria

So, how popular is PayPal in Nigeria? Here are some interesting stats to give you an idea:

- As of 2023, over 5 million Nigerians have PayPal accounts.

- Freelancers make up a significant portion of PayPal users in Nigeria, with over 60% using the platform to receive payments.

- Despite its limitations, PayPal remains one of the top choices for Nigerians looking to engage in international transactions.

Why You Should Trust PayPal in Nigeria

Trust is a big deal, especially when it comes to financial transactions. Here’s why you can trust PayPal in Nigeria:

1. Security Measures

PayPal employs state-of-the-art security protocols to protect your data and transactions. From two-factor authentication to fraud detection systems, they’ve got your back.

2. Global Reputation

With over 400 million active users worldwide, PayPal has established itself as a trusted name in the financial industry. Their commitment to transparency and customer satisfaction is unmatched.

3. Customer Support

PayPal offers 24/7 customer support to help you resolve any issues you might encounter. Whether it’s a transaction dispute or a technical problem, their support team is just a click away.

Conclusion: Is PayPal Worth It for Nigerians?

After exploring all the ins and outs of PayPal in Nigeria, it’s clear that the platform has its pros and cons. While there are limitations, such as sending money restrictions and withdrawal fees, the benefits of using PayPal—global reach, security, and convenience—make it a worthwhile option for many Nigerians.

If you’re still on the fence, consider this: PayPal is just one tool in your financial toolkit. By combining it with other platforms like Paystack or Flutterwave, you can create a robust system that meets all your needs.

So, what are you waiting for? Sign up for PayPal today and take the first step toward expanding your business globally. And don’t forget to share this article with your friends and colleagues who might find it helpful. Together, let’s make online transactions easier and more accessible for everyone in Nigeria!

Detail Author:

- Name : Dax Zemlak

- Username : marguerite26

- Email : zconn@yahoo.com

- Birthdate : 1994-07-19

- Address : 7751 Cali Harbors Suite 376 South Delaneyville, MO 51344-2036

- Phone : 269.524.9451

- Company : Kutch, Baumbach and Lesch

- Job : Travel Guide

- Bio : Mollitia nobis aut ducimus soluta odit ut blanditiis. Quasi nostrum qui rerum voluptates esse id et molestias. Sunt a enim cum vitae quia.

Socials

tiktok:

- url : https://tiktok.com/@barrystrosin

- username : barrystrosin

- bio : Enim et incidunt inventore quis doloremque et quasi.

- followers : 5560

- following : 2511

facebook:

- url : https://facebook.com/barry_strosin

- username : barry_strosin

- bio : Libero possimus cupiditate est et occaecati enim adipisci consectetur.

- followers : 6608

- following : 2641

twitter:

- url : https://twitter.com/barry_strosin

- username : barry_strosin

- bio : Quis mollitia molestiae sed culpa quasi ut. Eaque magni facilis et eveniet sapiente. Fuga quaerat itaque porro minus nisi. Ipsa asperiores quos et vero.

- followers : 6167

- following : 2715